The Federal Open Market Committee announced on Wednesday it would hold its federal funds rate target at 4.25 to 4.5 percent, ending the three-meeting rate-cut streak that began in September 2024. The decision was widely expected. Prior to the meeting, the CME Group put the odds of a rate cut at just 0.5 percent.

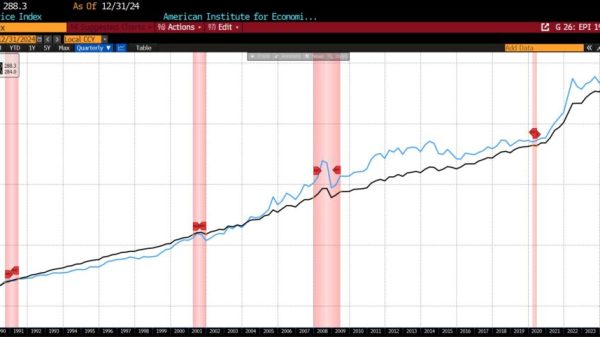

Fed officials began signaling the pause ahead of the December 2024 FOMC meeting, following less-than-stellar inflation readings for September and October. The Personal Consumption Expenditures Price Index (PCEPI), which is the Federal Reserve’s preferred measure of inflation, grew at a continuously compounding annualized rate of 2.0 percent over the six month period ending in August 2024. It grew at an annualized rate of 2.1 percent in September and 2.7 percent in October.

Core inflation, which excludes volatile food and energy prices, also increased. Core PCEPI grew at a continuously compounding annualized rate of 3.0 percent in September and 3.1 percent in October. It had averaged just 2.5 percent over the six months ending in August 2024.

Understandably, Fed officials began to worry that inflation might ultimately settle above target if policy continued on course. Speaking at AIER’s Monetary Conference on December 2, Fed Governor Christopher Waller said the recent data had “raised the possibility that progress on inflation may be stalling at a level meaningfully above 2 percent.” Fed Chair Jerome Powell similarly noted that inflation had come in “a little higher,” and said the Fed could “afford to be a little more cautious as we try to find neutral.”

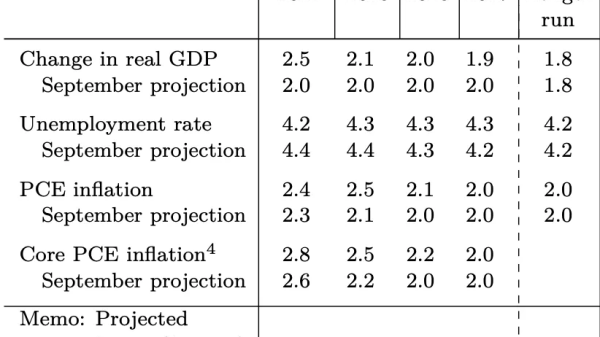

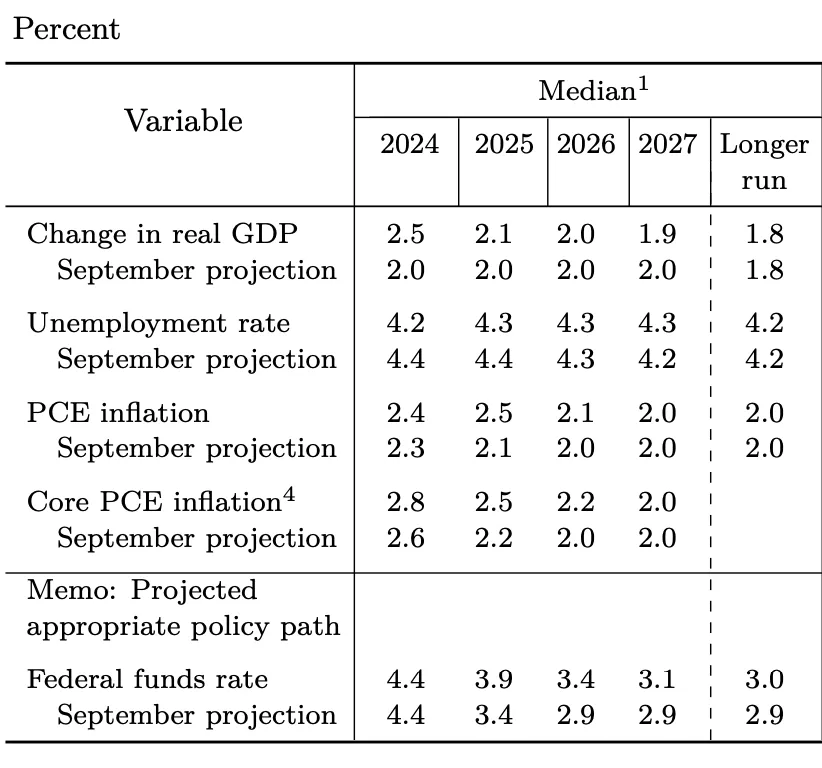

At the December meeting, the median FOMC member revised up projections for inflation from 2.3 percent to 2.4 percent for 2024; from 2.2 percent to 2.5 percent for 2025; and 2.0 percent to 2.1 percent for 2026. The projected federal funds rate rose in December, as well. The median member penciled in just 50 basis points worth of cuts for 2025, down from 100 basis points worth of cuts projected three months earlier.

Figure 1. Median FOMC member projections, December 2024

That’s where things get interesting. More recent data show that the PCEPI grew at a continuously compounding annualized rate of 1.5 percent in November 2024. Core PCEPI grew at an annualized rate of 1.4 percent. The data for December are set to be released later this week, but professional forecasters believe PCEPI growth will be around 2.2 percent and core PCEPI growth will be around 2.0 percent. If those forecasts are correct (and they are usually very close), average headline and core inflation over the last six months will be 2.0 percent and 2.3 percent, respectively. In other words, those worrisome September and October releases appear to be a blip.

If FOMC members revised the projected path of the federal funds rate out of concern following the September and October inflation readings, what will they do now that those readings appear to be a blip? One might expect they will revise their plans again, lowering rates by as much as 100 basis points this year (as they had projected back in September) rather than just 50 basis points (as projected in December). Alas, that does not appear to be the case.

“With our policy stance significantly less restrictive than it had been, and the economy remaining strong, we do not need to be in a hurry to adjust our policy stance,” Powell said at Wednesday’s post-meeting press conference.

There are at least two reasons why FOMC members might hesitate to announce their intention to cut rates by more than 50 basis points this year despite the more recent inflation data, which suggests the September and October uptick was just a blip. First, difficulties associated with seasonal adjustments could cause measured inflation to rise in the first few months of 2025. Fed officials might want to see how those readings look before changing plans. Second, they might believe the neutral rate of interest — commonly known as r-star — has risen or will rise over the coming months. President Trump’s pro-growth regulatory reforms or budget-busting fiscal policy reforms could cause the neutral interest rate to rise, reducing the distance the current federal funds rate will need to fall.

The FOMC will release new projections on inflation and the federal funds rate in March. Until then, we are parsing statements from Fed officials to figure out how their views are evolving. If they continue to expect high inflation, despite data to the contrary, and delay adjusting the path back to neutral in line with the available data, the risk of recession will rise.