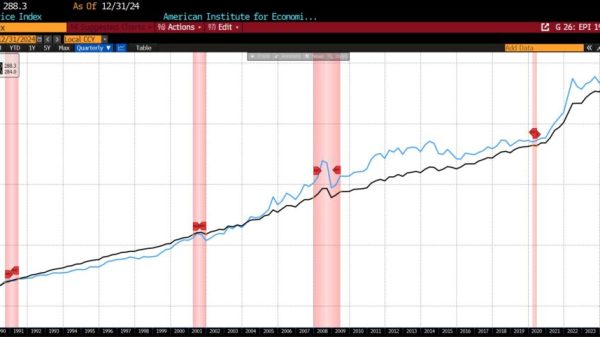

Prices still pinch: The Bureau of Labor Statistics announced the Consumer Price Index (CPI) rose 0.4 percent in December and 2.9 percent over the past year. The major cause was energy prices, which rose 2.6 percent last month and accounted for “over forty percent of the monthly all items increase.”

Core inflation, which excludes volatile food and energy prices, looks better. It rose 0.2 percent in December, down from 0.3 percent in the previous four months. This may be small consolation to struggling households, but it does portend continued disinflation. Variability in food and energy prices will likely smooth out. The underlying price pressures look favorable.

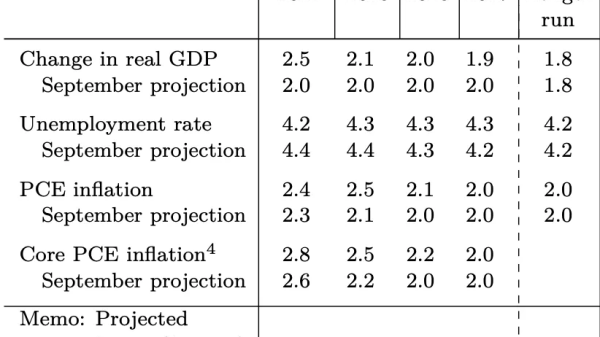

Does the new data affect the Fed’s plans for monetary policy? The current target range for the federal funds rate is 4.25 to 4.50 percent. Adjusting for inflation using the headline CPI figure yields a real target range of 1.35 to 1.60 percent. We need to compare this to the natural rate of interest to tell whether monetary policy is tight or loose. Estimates from the New York Fed put this somewhere between 0.77 and 1.26 percent in Q3:2024. The real rate range is above the natural rate range, indicating tight money.

However, this isn’t the only estimate of the natural rate of interest—not even the only one used by the Fed. The Richmond regional Reserve Bank cites another figure, putting it somewhere between 1.60 and 3.79 percent. The median estimate is 2.53 percent as of Q3:2024. If these numbers are more accurate, monetary policy is loose.

We should also consult money supply data. The M2 measure of the money supply has grown 3.66 percent over the last year. Liquidity-weighted Divisia aggregates have risen between 3.19 and 3.49 percent. But money supply data isn’t sufficient either. We need to know money demand as well.

We can approximate money demand by summing real economic growth and population growth. This approximation is reasonable so long as we don’t expect the public wants to hold a markedly different share of their portfolio in cash balances. The US economy grew 2.7 percent annually in Q4:2023, and the population grew at roughly 0.5 percent. Hence money demand is up approximately 3.2 percent. It’s growing about as fast as the money supply, suggesting monetary policy is close to neutral.

The next FOMC meeting is January 28-29. It previously told markets to expect fewer target rate cuts in 2025. The new CPI data reinforces this caution. Judging by interest rates is hard at this point in the Fed’s (potentially long) path back to neutral because estimates of the natural rate of interest vary widely. Judging by monetary conditions, however, policy is about where we want it. The Fed should pause its cuts, keeping monetary policy steady until we see confirmation that the spike in energy prices was an aberration, and that broader price pressures continue to moderate.